Integrating ESG with Business Values for Sustainable Development

Integrating ESG with Business Values for Sustainable Development

Previously, in "ESG to Capital for Tech Entrepreneurs," we explored the crucial role of ESG in business, detailing its definition, importance, and impact on business value chains. We highlighted how ESG presents both opportunities and risks, urging immediate action.

Now, we focus on practical applications. We’ll share insights from diverse companies on their ESG implementation experiences, from initial concepts to real-world practices. We’ll also include perspectives from the SEC on One Report preparation for new business policies and what investors look for in ESG criteria.

Embracing ESG Excellence in Tech Start up

By Dr. Aeimporn Panyasai

Executive Director and CEO, Pacific Pipe Public Company

Limited

Pacific Pipe's ESG Journey

Pacific Pipe, a leading steel pipe manufacturer, embraced the ESG framework in 2017 to drive sustainable development. Early adoption has advanced their strategies, positioning them to meet today's challenges. Here’s how they approached ESG implementation.

Understanding Your Business is Crucial

Before integrating ESG, businesses must understand and establish their vision, challenges, strategies, and goals. ESG should complement business activities by aligning them with the core values and strengths.

Understanding your business's value chain and seamlessly integrating ESG principles into your vision and mission is essential for cohesive execution.

Transforming Vision into Action

Start by identifying stakeholders involved in your business processes. Examine each step in your value chain to determine where ESG elements can be incorporated. Engage stakeholders transparently in decision-making, set clear goals, and develop actionable strategies. Continuous monitoring ensures adherence to plans and future improvements.

Data-Driven Decision-Making for ESG Success

To ensure the business progresses as planned, Pacific Pipe integrates various Performance Matrices into the organization's KPIs. This key indicator assesses progress through a Performance Management System using tools like:

- CEO Scorecard: Breaks down operations into various aspects, ensuring alignment with business and ESG (Environmental, Social, and Governance) dimensions.

- KPI: Each baseline measure is subdivided according to ESG dimensions, covering economic, social, and environmental aspects.

These measures rely on a clear performance measurement system to set realistic goals and actionable plans. Consistent analysis of outcome data is essential to evaluate project efficiency, identify impacts, and determine areas for improvement.

Sustainable Development Perspectives on the Thai Stock Market

The Thai Stock Exchange views sustainable businesses through three pillars: Economic, Social, and Environmental.

Economic -> Drive economic value and ethical profitability with good governance.

Social -> Treat stakeholders fairly and improve societal well-being.

Enviroment -> Efficiently use resources and minimize environmental impact.

SET’s Nine Sustainable Attributes:

- 1. Competent and ethical personnel

- 2. Transparent governance

- 3. Risk assurance

- 4. Global trend adaptation

- 5. Innovation-driven solutions

- 6. Profit growth

- 7. Stakeholder benefits

- 8. Social quality enhancement

- 9. Environmental balance

Integrating ESG into all organizational aspects, from policies to daily operations, is key to achieving true sustainable development.

Applying IMM to One Report by SEC

By Ms. Winita Kultangwatana

Director, Environmental, Social and Governance

Department, SEC

Part 1: The Importance of ESG and SDGs in Business Operations

“ESG risks are business risks.”

Many businesses have suffered immense damage before grasping the importance of this statement. Ignoring ESG principles led them to face significant business risks, resulting in substantial costs to mitigate these damages. Incidents like oil rig explosions, environmental conflicts, and corporate fraud allegations have brought about severe consequences.

Beyond penalties, there’s the risk of missed opportunities. The global trend increasingly emphasizes ESG, as evidenced by:

- - 2023 Global Investor Study: Over 33 countries show investors seeking sustainability in businesses (source)

- - The EU Directive on Corporate Sustainability Due Diligence: Mandates transparency and compliance with ESG standards.

- - The Carbon Border Adjustment Mechanism (CBAM): Imposes greenhouse gas taxes on certain imported goods into the EU, affecting business exports.

- - Sustainability Outlook 2024: Investors prioritize ESG-integrated companies with adaptive strategies responding promptly to global changes.

These trends and trading conditions force businesses away from greenwashing towards genuine ESG commitments.

Part 2: SEC's Role in Driving Sustainable Capital Markets in Thailand

Vision: “SEC is ready for change, developing sustainable capital markets and economy to benefit all sectors." Mission: "Regulate and develop the capital market to be credible, efficient, and accessible to all.”

Thai businesses are pillars of the national economy. For investors to trust in long-term returns, sustainable business development is crucial. SEC's role is to promote sustainability across all business areas to ensure resilience amidst global changes. This support led to the creation of the One Report.

Part 3: Reporting with 56-1 One Report

The 56-1 One Report supports sustainability by mandating annual business disclosures. Principles include accuracy, adequacy, current relevance, completeness, and non-misleading information, enhancing transparency for investor decision-making. Report content includes:

- Sustainability policies and goals

- Stakeholder impact management within the value

chain:

- - Clear objectives and measurable goals for tracking progress and identifying improvement areas.

- Environmental sustainability management:

- - Clear policies and performance reports on:

- - Energy usage

- - Water consumption

- - Greenhouse gas reduction strategies

- - Waste and emissions management

- - Clear policies and performance reports on:

- Social sustainability management:

- - Policies and practices aligned with short and long-term strategies, risk management, and performance outcomes.

Each industry's report content varies, reflecting unique operational aspects. Further details can be found on the SEC One Report page

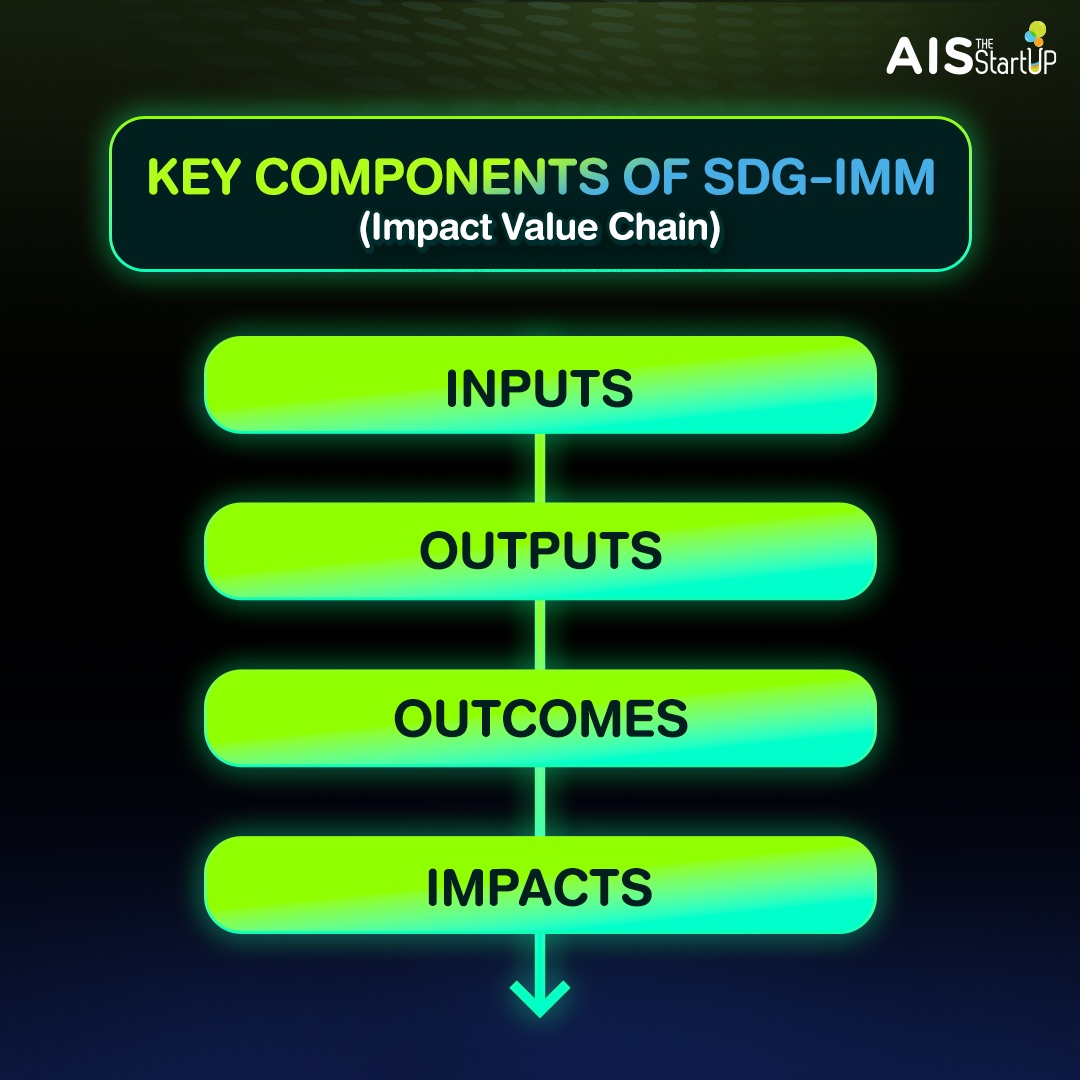

Part 4: Impact Measurement and Management (SDGs-IMM)

The SDGs (Sustainable Development Goals) encompass 17 global objectives established by the UN in 2015, targeting peace and prosperity for people and the planet. Businesses should align relevant SDGs with their values.

Impact Measurement and Management (IMM) measures direct and indirect business impacts concerning stakeholders, including the environment and society. It’s vital as investors seek businesses accountable for their societal and environmental impact. Employing a standardized ESG framework enhances comparability and credibility among businesses.

Steps for Implementing IMM:

- Understand IMM and its impacts:

Learn about SDGs and evaluate the potential impacts.

- Identify and engage stakeholders:

Identify all stakeholders in the value chain, including society and the environment.

- Prioritize impacts:

Rank goals to address the most significant impacts first.

-

Plan for impact:

Develop an Impact Value Chain:

- Inputs: Activities addressing issues or opportunities

- Outputs: Tangible results from activities

- Outcomes: Benefits from project results

- Impacts: Long-term changes in economic, social, and environmental areas

- Measure and refine:

Collect and analyze data to improve SDG goals and manage future impact risks.

- Report progress:

Document progress and development plans in reports like One Report for the SEC and investors.

Global Reporting Initiative (GRI)

by Ms. Mayuree Aroonwaranon

Chief Executive Officer at GEPP Sa-Ard

The GRI standards are designed for organizations to report on economic, social, and environmental impacts. Established by an international independent organization, GRI helps businesses understand and communicate their sustainability performance.

Why Use GRI?: GRI is a globally recognized standard, enhancing investor comparability and understanding of business sustainability. It encourages businesses to address past incidents and prevent future issues, ensuring they ask critical questions today to avoid problems tomorrow.

What is GRI?: GRI standards cover various criteria, tailored to different business types and industries, reflecting impacts on the economy, environment, and society. Key GRI topics include:

- GRI418: Customer Privacy -> Ensure compliance with privacy laws like PDPA. Addressing data breaches and privacy concerns is crucial given the rising awareness and litigation risks.

- GRI205: Anti-Corruption -> Develop policies to prevent corruption, demonstrating transparency and preventive measures. B2B companies should study similar businesses and align legal teams to draft compliant policies.

- GRI306: Waste -> Waste Management: Assess waste across the business chain, including suppliers. Poor waste management by suppliers requires businesses to seek better partners.

- GRI203: Indirect Economic Impacts -> Evaluate how business activities create direct and indirect economic impacts, like job creation and community income.

- GRI204: Procurement Practices -> Ensure suppliers comply with laws and do not exploit labor or harm the environment.

- GRI405: Diversity and Equal Opportunity -> Promote diversity and equality in the workplace, addressing gender imbalances and discriminatory practices.

How to Implement GRI :

- Assess Impacts: Review existing reports to identify relevant sustainability issues and develop collaborative action plans with related departments.

- Engage with Stakeholders: Consult with internal and external stakeholders to involve them in projects and assess impacts collectively.

- Develop Content: Refine the plan and objectives based on stakeholder input to ensure plans add real value to the business.

- Monitor Progress: Track indicators, analyze data for transparency and usefulness, and refine strategies based on findings.

- Report Sustainability Strategies: Communicate progress to stakeholders, detailing economic, social, and environmental developments. Tailor communication formats to the audience's needs.

Benefits of GRI Implementation:

- Reputation and Credibility: Like ISO certifications, GRI compliance confirms ESG standards, potentially leading to more credibility and future certifications supporting economic, social, and environmental efforts.

- Investor Attraction: Investors now favor sustainable, adaptable companies. Those balancing profitability with positive impact are more attractive.

- Employee Development: Engaging employees in GRI fosters involvement and growth, promoting innovative thinking and improvement in work processes.

- Sustainable Development Pathway: Starting with ESG enables learning and refinement. It helps businesses understand the necessary steps for sustainable value creation and allows room for improvement.

- Competitive Advantage: The growing CnSR (Consumer Social Responsibility) segment prefers responsible businesses. Communicating ESG efforts positions businesses favorably to this expanding customer base, providing a competitive edge.

Business and Capital Opportunity with ADB

by Ms. Thitirat Sittakaradej

Principal at Asian Development Bank (ADB)

& Mr. Supapong Kittiwattanasak

Co-Founder MuvMi

The Asian Development Bank (ADB) aims to support the economic and developmental progression of Asian countries. ADB provides investment and funding assistance to businesses, particularly in the seeding stage, to foster sustainable growth. Early-stage businesses, often facing growth challenges, receive backing in sustainability development as long-term investors prioritize this aspect.

Current Focus Areas of ADB:

ADB's current investment interests pivot around Climate Change Integration. They support businesses in incorporating ESG practices to address global climate challenges.

Key areas include:

- Clean Energy and Industry: Promoting energy-efficient and sustainable industrial practices.

- Sustainable Mobility and Supply Chains: Encouraging eco-friendly transportation and logistics solutions.

- Sustainable Agriculture and Food: Supporting agricultural practices that are environment-friendly and sustainable.

- Circular Economy and Green Materials: Advancing zero-waste practices and the use of sustainable materials.

- Green Finance and Data: Facilitating financial practices that support sustainable projects and transparent data management.

- Inclusive and Resilient Communities: Building communities that are adaptable and inclusive, minimizing the environmental impact.

According to ADB’s data, over 80% of current investments demand businesses to mitigate and adapt to climate-related impacts.

Impact & Additional Model

- Strong Integrity Standard

ESG principles must integrate seamlessly with business operations, ensuring transparency and comprehensibility for stakeholders. A lack of integrity can erode trust, which is essential for business viability.

- Active E&S Risk Management

Managing environmental and social risks is vital. Neglecting these responsibilities can introduce significant risks and costs to businesses.

- Impact Monitoring

Embed impact evaluation into business operations. For example, assess the environmental benefits of each EV sold, or measure the risk mitigation impact in the insurance sector. Continuous impact monitoring identifies potential improvements and outcomes of business activities.

- Crowding-in Capital

Facilitate capital raising for startups not involved in climate-specific investments. Having previously collaborated with multiple companies allows ADB to offer due diligence and advisory services based on past successful engagements.

- Technology Discrimination

Ensure fair use of technology and data. Compliance with laws and internal policies is crucial to avoid discriminatory practices, thereby protecting businesses from potential legal and ethical issues.

Knowledge Sharing from MuvMi

Mr. Supapong Kittiwattanasak Co-Founder MuvMi

Experience Sharing from MuvMi

MuvMi started with the vision of creating an efficient, safe, and equitable urban transportation solution, tailored to the evolving needs of city dwellers. Recognizing the inefficiencies in urban travel caused by structural issues, MuvMi aimed to alleviate these challenges by facilitating easier neighborhood transport, reducing reliance on personal vehicles, and ultimately benefiting society and the country.

Key Success Factors

Accessibility and Affordability: MuvMi’s success hinges on making transportation accessible and encouraging ride-sharing within neighborhoods to lower individual travel costs. The fleet of EVs helps keep operational costs low, maximizing revenue while ensuring high-quality service with clean vehicles and skilled drivers.

Versatile Solutions: Beyond passenger transport, MuvMi has expanded into other services such as parcel delivery and shuttle services for condominiums, enhancing neighborhood accessibility comprehensively.

ESG Integration Journey

Despite operating an EV-based business, MuvMi initially did not qualify as an ESG (Environmental, Social, Governance) business. The fundraising process highlighted this gap, resulting in a 300-page framework evaluating various business impacts, risks, and opportunities akin to the Global Reporting Initiative (GRI) standards.

Practical ESG Practices

Diversity and Inclusion: Employing a diverse driver population, including seniors. MuvMi collects data on drivers' gender and age to identify turnover rates and other relevant trends, ensuring a balanced and inclusive workforce.

Lastest articles