For novice entrepreneurs, talking about accounting and taxes can be a headache right away because it could be difficult to understand, various steps of work, and full of numerical data to use.

But when planning to scale the business, this stuff is undeniable. Because if entrepreneurs have no understanding and ignore the matter, it may result in obstacles and problems in business. So, today, AIS The StartUp has gathered information about basic accounting and tax for new business people. It's not as difficult as you think. Let's take a look!

Accounting overview that you should know

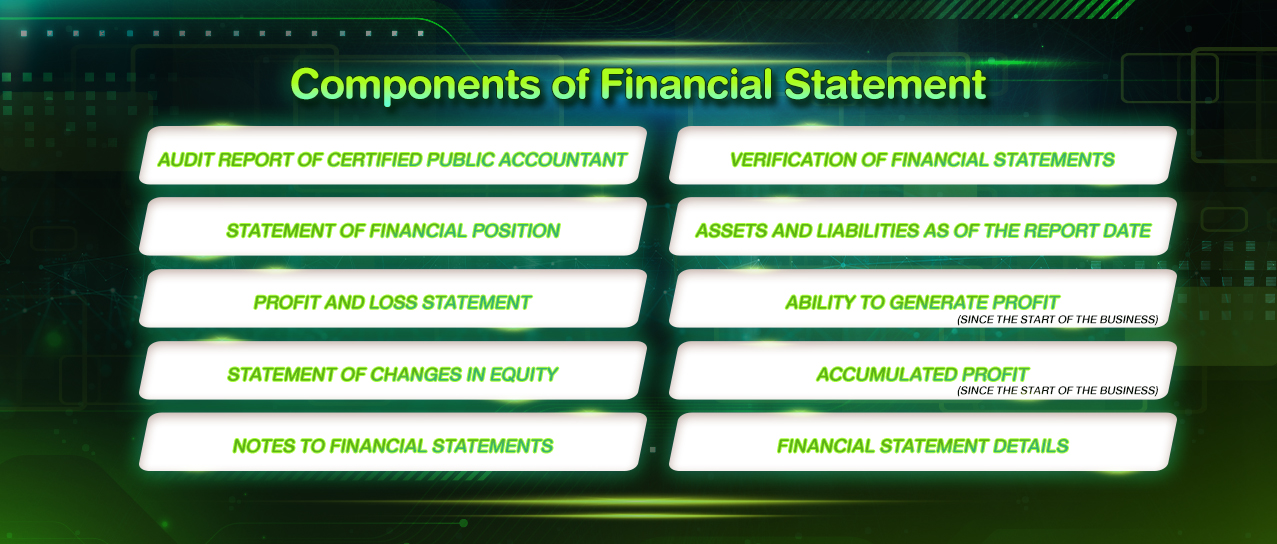

Let's start with the 'financial statements' or financial reports of the business. Which collecting all expenses, income and profits of the business at the accounting period to summarize the results of the company's performance. Financial statements are important information for any startup or small business, and can be divided into 5 parts as follows:

- Audit Report of Certified Public Accountant - When closing the annual financial statement, the company must submit financial statement information to a certified public accountant to verify and confirm the credibility of the financial statements.

-

Statement of Financial Position - This statement provides a snapshot of the financial

condition of a business, resources, liabilities, and equity of an organization as of the

report date, such as assets, cash, debtors, property, buildings, equipment, or as to the

accounting equation that many people are familiar with:

Assets = Liabilities + Owner's Equity

- Profit and loss statement - This provides information about a company’s ability to generate profit in that year and provides a look at a company’s overall financial performance to be used to assess taxes on profits earned.

- Statement of Changes in Equity - This statement provides accumulated profit and loss since the start of the business to the present, by measuring the changes in equity, for entrepreneurs to use to manage the company's equity.

- Notes to financial statements - These are supplemental notes that are included with financial statements, which plays an important role in helping entrepreneurs plan their business strategies in the coming years.

Interestingly, the 5 components of the 'financial statement' are related to each other. Therefore, if your company has accurate accounting, it will enable the financial statements to be clearly checked.

Analyze the Auditor Reports page.

After we know the origin of the financial statement elements, for entrepreneurs, there is another point to pay attention. Which is what to do after receiving financial statements from an accountant, in order to prevent mistakes in the financial statements before issuing the report, that can result in the stumble of loan applications with financial institutions or of other business processes. Therefore, entrepreneurs must ...

Consider the auditor's report "before" signing the financial statements every time.

Techniques for analyzing the Certified Public Accountant's Report page. “Unqualified” is the best, because it means that the information of our company shown on the financial statements is "accurate" as it should be. You can notice the text format on the report, that the comment section heading (first paragraph) will be labeled “Opinion”.

So, what are the other opinions can we find on the Certified Public Accountant's Report page?

- “Qualified” means that the financial statements contain material misstatements, and the auditor was unable to find evidence to verify that information.

- “Adverse” means that the financial statements contain material misstatements, and that information is important.

- “Disclaimer” means that there is information that the auditor is unable to obtain sufficient evidence for and that information is important.

How many types of taxes are there ? And, what is the tax base ?

Taxes under the Internal Revenue Code levied by the IRS pertaining to small and medium-sized businesses, such as startups or SMEs, can be categorized as follows:

- Income tax base - personal income tax, corporate income tax, withholding income tax

- Consumption base (goods and services) - VAT

**The more the tax bases = the more the taxes you pay**

Taxes is considered as a part of business expenses, with the tax rate of 15% for SMEs, 20% for juristic persons, that can be calculated from taxable profit, not accounting profit. And don't forget to file your income tax twice a year as required by law.

Financial statement period and the time for filing annual financial statements.

Accounting should start from the date of registration as a juristic person. Within 12 months, the financial statements must be closed and submitted to the Department of Business Development.

For example, if the end of accounting period of the company is on 31 December. The timeline can be set as follows:

- Hold an Annual General Meeting of Shareholders by 30 April.

- Submit documents BorOrJor. 5 or file lists of shareholders by May 14.

- Submit Phor.Ngor.Dor. 50 or corporate income tax submission within 30 May.

- Submit financial statements by May 31.

In addition, entrepreneurs can also choose to use accounting software, such as Flow account, as a help, which is a feature-rich digital technology, to help increase peace of mind in managing the accounting and numbers, and help collect various operational activities to use for future business planning.

Apply to be a part of the AIS The StartUp project today. Just submit your work to join the selection. Click http://www.ais.th/thestartup/connect.html

All contents in the article are based on AIS SME Growth Webinar dated 6 October 2022 - Summary of Accounting and Tax Techniques. Let entrepreneurs make difficult things easy.

Lastest articles